It’s our favorite day of the week: FRY-nancial FRY-day! AI has the financial world in a frenzy, so let’s check it out. 🤑

*None of what we offer is investment advice. Our aim is to report the latest happenings and teach you how to use the newest AI finance tools.*

🤯 MYSTERY AI LINK 🤯

(The mystery link can lead to ANYTHING AI-related: tools, memes, articles, videos, and more…)

Today’s Menu

Appetizer: Apple shares reach record high after AI announcements 📈

Entrée: This week’s diamond in the rough 💎

Dessert: Uncover trending stocks, based on online chatter 🤑

🔨 AI TOOLS OF THE DAY

🛒 Informr: Find and compare the best prices and reviews for all sorts of products and services. → check it out

💸 Era: Smart money management powered by AI and humans. → check it out

🙏 My Legacy: Manage and secure your digital assets, ensuring a smooth transition of your monetary presence after you’re gone. → check it out

APPLE SHARES REACH RECORD HIGH AFTER AI ANNOUNCEMENTS 📈

Q: Why was the apple uncomfortable in the fruit bowl?

A: Pear pressure. 🍐

What’s going on? Apple (AAPL) shares soared to a new record high of $220.20 per share this week, surpassing the previous record set in December. This surge followed the company’s annual developer conference on Monday, where Apple unveiled its long-anticipated foray into AI.

Why is the stock surging? During their WWDC event, Apple introduced a suite of new AI features, including enhancements to Siri, integration with OpenAI’s ChatGPT, various writing assistance tools, and customizable messaging features. Analysts from Morgan Stanley stated, “Following a WWDC that delivered on the key details we were focused on heading into the event, we have even greater conviction that Apple is on the cusp of a multi-year product refresh.”

What’s the significance? Apple has been doubted over and over for falling behind rivals Google and Microsoft in the AI race. This week, however, marks a significant stride in its development and growth. Apple has officially entered the AI party, and the market is beginning to reflect that.

THIS WEEK’S DIAMOND IN THE ROUGH 💎

AI is creating precious diamonds, and we are here to uncover them! 🕵️♂️

This week’s diamond in the rough: This week’s diamond in the rough is SoundHound AI (SOUN).

How is AI helping SOUN? SoundHound develops voice AI and speech recognition technologies. Their products allow users to have natural conversations with voice assistants and help businesses create conversational experiences for their customers.

Why is SOUN valuable? Earlier this year, SoundHound stock shares exploded over 400% in value. This was mostly due to the incorporation of speech recognition and AI voice technologies in various models, which pushed profits up 80%. This growth was also attributed to Nvidia’s interest in SoundHound’s technology. Despite a recent market correction, SoundHound’s stock value has leveled out and is still up over 100% since January. The company’s leaders used this market explosion to sell shares of their stock and accumulate cash, which is now being used to fuel another upswing. This week, SoundHound reached an agreement with its lenders to prepay its outstanding $100 million debt in full. This frees up $14 million of restricted cash and will save SoundHound over $55 million of interest and fees. Now, the company has a total of $180 million of outstanding cash. Nitesh Sharan, CFO at Soundhound, is excited about the power this cash gives them going forward. He stated, “We now have a capital structure free of debt, which will allow us to move even more nimbly to capture the increasing customer demand for our voice AI solutions.”

HOW ARE THE MAGNIFICENT 7 DOING? 📈

Company: | Thursday Closing Price (±% from last week): |

|---|---|

Amazon (AMZN) | $183.83 (-0.6%) |

Apple (AAPL) | $214.24 (+10.1%) |

Alphabet (GOOGL) | $175.16 (-0.2%) |

Meta (META) | $504.10 (+2.1%) |

Microsoft (MSFT) | $441.58 (+4.0%) |

Nvidia (NVDA) | $129.61 (+7.1%), 10-1 split |

Tesla (TSLA) | $182.47 (+2.6%) |

UNCOVER TRENDING STOCKS, BASED ON ONLINE CHATTER 🤑

What if internet chatter could make you rich? 💬

What’s up? Uptrends AI scans tens of thousands of online articles and social media posts each day to uncover trending stocks, based on online chatter.

How to use the tool:

Sign up on Uptrends for free with your email (premium subscriptions are available as well).

Search through the most trending stocks by category: most bullish, most bearish, most mentioned, and surging mentions.

Create a “watchlist” of your favorite stocks.

Choose “alerts” for your watchlist to get alerted about market-moving events affecting stocks on your watchlist, from lawsuits and earnings chatter to mergers, acquisitions, and more.

Get notified! Opt-in for weekly emails summarizing the events affecting stocks on your watchlist so you can stay on top of trends and ahead of the crowd, without the FOMO.

FRY-AI FANATIC OF THE WEEK 🍟

Congrats to our subscriber, senborni28! 🎉

Senborni28 gave us a Fresh and Crispy review and wrote, “Very informative 👍”

(Leave a comment for us in any newsletter, and you could be featured next week!)

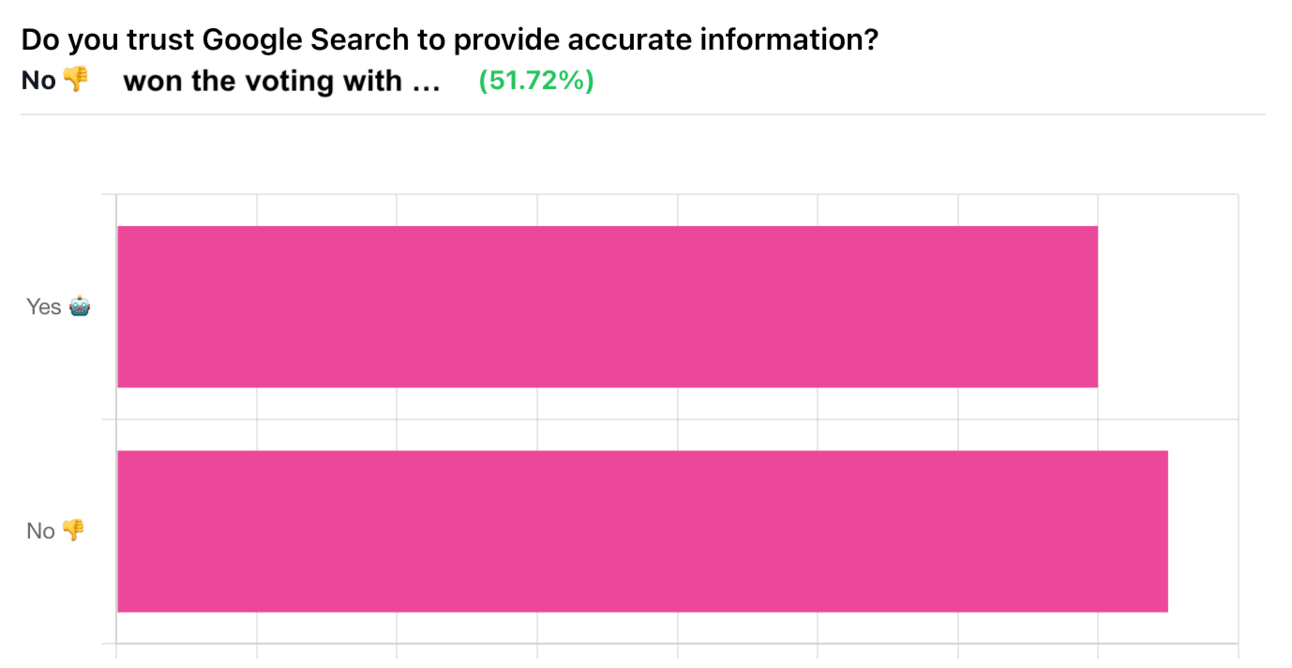

YESTERDAY’S POLL RESULTS 📊

Featured comments:

“Google has a political bias. Any topic, subject or person that is not in line with their perspective and globalist vision will be at the very minimum misrepresented. Their algorithms have built in ‘fact checkers.’ They have abandoned their initial raison d’etre.” (No 👎)

“If I want a left wing biased response to my questions, then Google is ‘accurate.’ If I want unbiased answers I’ll go to Duck Duck Go or another browser not made by Google, Apple, or Microsoft.” (No 👎)