Happy FRY-nancial FRY-day! Money has been flying around all week in the AI world, and today is the day of the week when we get you up to speed. 🤑

*The content provided in this newsletter is for informational purposes only and does not constitute investment advice.*

🤯 MYSTERY AI LINK 🤯

(The mystery link can lead to ANYTHING AI-related: tools, memes, articles, videos, and more…)

Today’s Menu

Appetizer: Salty Stories of the Week 🧂

Entrée: This Week’s Diamond in the Rough 💎

Dessert: FRY-nancial Tool of the Week 🔧

🔨 AI FINANCE TOOLS OF THE DAY

🙅♂️ Spend Less: A free Chrome extension to help you spend less money online. → Check it out

🤝 Numeric: AI-powered close automation. → Check it out

🤖 Cube: Streamline your FP&A processes. → Check it out

SALTY STORIES OF THE WEEK 🧂

Want some seasoning? Here are the saltiest AI stories in FRY-nance from this week:

Chinese tech giants have placed $16 billion worth of orders for Nvidia’s high-end AI chips over the past three months. Big names like ByteDance, Alibaba, and Tencent are racing to build powerful AI tools, and these chips are the key. But supplies are limited, and these companies are trying to get as many as they can before U.S. restrictions tighten further. At the same time, U.S. companies like Apple and OpenAI are also buying Nvidia’s AI systems, showing just how important Nvidia has become in the global AI race. Simply put: everyone wants Nvidia’s tech, and they’re scrambling to get it while they still can. (Read More)

OpenAI has secured $40 billion in new funding, raising its total value to $300 billion. Most of this financial support is from its partner SoftBank, a leader in scaling technology. With this increase in funding, OpenAI aims to accelerate scientific breakthroughs, boost personalized learning, spark creativity, and move closer to developing artificial general intelligence (AGI). (Read More)

OpenAI doesn’t expect to become cash-flow positive until 2029, according to Bloomberg. Despite fast-growing revenue—projected to hit $12.7 billion in 2025—the company is still spending heavily on expensive computer chips, data centers, and top AI talent. However, OpenAI predicts it will earn over $125 billion by 2029, driven by strong demand for its paid AI tools like ChatGPT. Since launching the chatbot, OpenAI has rolled out multiple subscription services and recently surpassed 2 million paying business users. (Read More)

THIS WEEK’S DIAMOND IN THE ROUGH 💎

Whenever you walk into an electric car dealership, the first thing you should ask is how much they charge. 🚗

How is Nio using AI? Nio is a Chinese electric vehicle (EV) company that designs and sells smart, premium electric cars. It’s also investing heavily in AI to improve its vehicles and lower costs. For example, Nio recently developed its own self-driving technology—including both software and chips—so it doesn’t have to rely on outside suppliers. This gives the company more control over its products and helps it compete in China’s fast-growing EV market.

Want some numbers? Nio’s stock is trading at its lowest valuation ever, even though the company continues to grow revenue. It brought in $9 billion in 2024, and vehicle deliveries jumped 49% in the first two months of 2025. However, it’s still losing money—$3 billion last year—due to intense price competition in China, high marketing and production costs, and the cost of upgrading its car platforms. Despite those challenges, Nio is working to cut expenses and recently launched a new budget-friendly brand, Onvo, which could help expand its customer base and support future growth.

HOW ARE THE MAGNIFICENT 7 DOING? 📈

Company: | Thursday Closing Price (±% from last week): |

|---|---|

Amazon (AMZN) | $178.41 (-12.9%) |

Apple (AAPL) | $203.19 (-10.1%) |

Alphabet (GOOGL) | $150.72 (-7.6%) |

Meta (META) | $531.62 (-13.3%) |

Microsoft (MSFT) | $373.11 (-4.7%) |

Nvidia (NVDA) | $101.80 (-9.5%) |

Tesla (TSLA) | $267.28 (-2.2%) |

FRY-NANCIAL TOOL OF THE WEEK 🔧

I wanted to be an investment banker when I grew up, but then I lost interest. 🙃

What is the tool? Value Sense is a comprehensive stock analysis platform designed to assist investors in identifying undervalued stocks and making informed investment decisions.

What are the key features?

Stock Screener: Filter stocks by metrics like price, ROIC, and dividend yield.

Intrinsic Value Tools: Estimate fair value using DCF, earnings growth, and other models.

Advanced Charting: Build custom charts using professional financial data.

Earnings Reports and Calendar: Track quarterly results and upcoming earnings dates.

Stock Ideas: Discover curated lists of undervalued or high-performing stocks.

Automated Analysis: Get AI-generated reports and value estimates for any company.

FRY-AI FANATIC OF THE WEEK 🍟

Congrats to our subscriber, jsnapp! 🎉

Jsnapp gave us a Sizzling review and wrote, “Always spot on with AI!”

(Leave a comment for us in any newsletter, and you could be featured next week!)

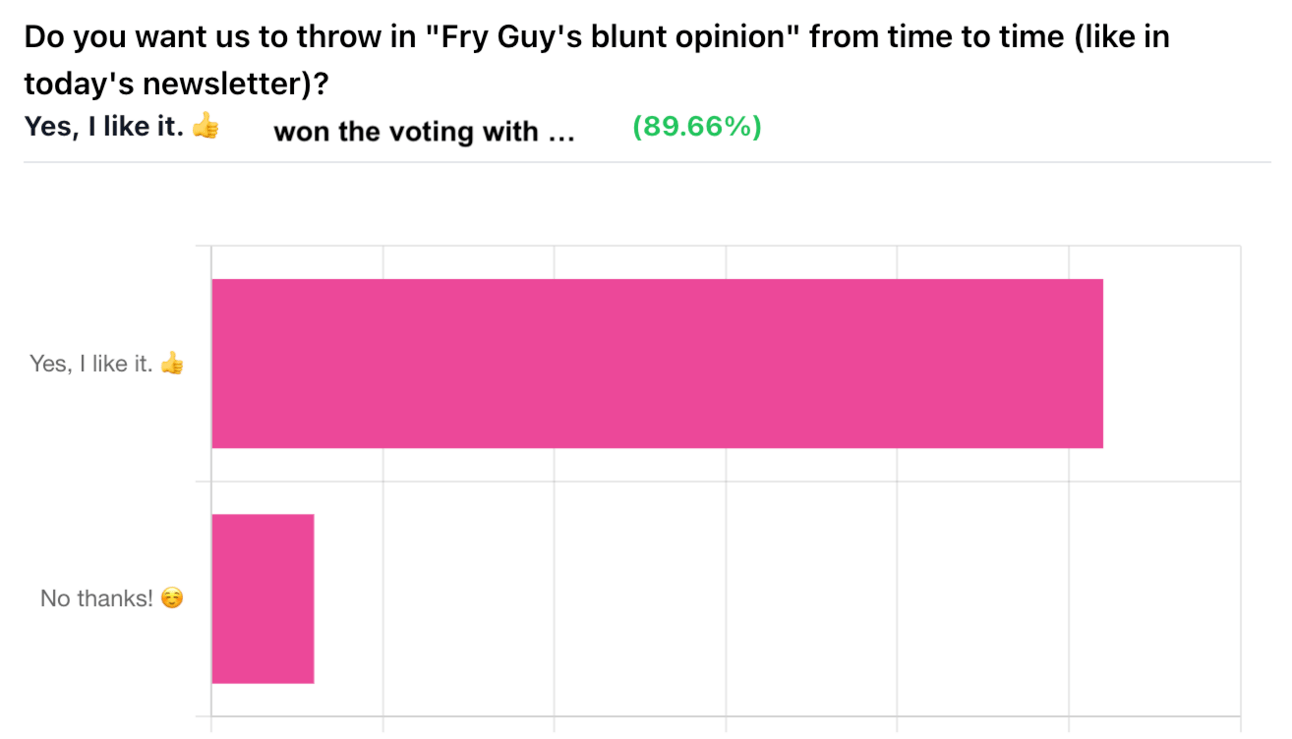

YESTERDAY’S POLL RESULTS 📊

We hear you! We will add this sporadically.

HAS AI REACHED SINGULARITY? CHECK OUT THE FRY METER BELOW:

You’ve heard the hype. It’s time for results.

After two years of siloed experiments, proofs of concept that fail to scale, and disappointing ROI, most enterprises are stuck. AI isn't transforming their organizations — it’s adding complexity, friction, and frustration.

But Writer customers are seeing positive impact across their companies. Our end-to-end approach is delivering adoption and ROI at scale. Now, we’re applying that same platform and technology to build agentic AI that actually works for every enterprise.

This isn’t just another hype train that overpromises and underdelivers. It’s the AI you’ve been waiting for — and it’s going to change the way enterprises operate. Be among the first to see end-to-end agentic AI in action. Join us for a live product release on April 10 at 2pm ET (11am PT).

Can't make it live? No worries — register anyway and we'll send you the recording!

What do ya think of this latest newsletter?

Your feedback on these daily polls helps us improve the newsletter—so keep it coming!