Wall Street’s got bulls and bears—we’ve got bots and burners. Welcome to FRY-nancial FRY-day. 🔥

*The content provided in this newsletter is for informational purposes only and does not constitute investment advice.*

Get the tools, gain a teammate

Impress clients with online proposals, contracts, and payments.

Simplify your workload, workflow, and workweek with AI.

Get the behind-the-scenes business partner you deserve.

🤯 MYSTERY AI LINK 🤯

(The mystery link can lead to ANYTHING AI-related: tools, memes, articles, videos, and more…)

Today’s Menu

Appetizer: Salty Stories of the Week 🧂

Entrée: This Week’s Diamond in the Rough 💎

Dessert: FRY-nancial Tool of the Week 🔧

SALTY STORIES OF THE WEEK 🧂

Want some seasoning? Here are the saltiest AI stories in FRY-nance from this week:

Catena Labs, founded by Circle co-founder Sean Neville, has raised $18 million to build a new kind of bank designed specifically for AI. The idea is that in the near future, AI programs—or “AI agents”—will carry out most financial transactions, such as buying, selling, or investing. This new institution will be built to work directly with those AI agents, using AI systems to run its operations, while humans oversee and guide them. The goal is to create a fully regulated, AI-first financial system that can safely and efficiently handle the growing role of AI in the economy. (Read More)

“Banks are dinosaurs.”

In a $6.5 billion deal, OpenAI is acquiring a hardware startup called io, founded by former Apple design legend Jony Ive and several of his longtime collaborators. The team includes top engineers and designers who helped build some of Apple’s most iconic products. By bringing io into the fold, OpenAI hopes to create innovative devices that work seamlessly with its AI tools. (Read More)

A new report from Silicon Valley Bank found that ~40% of U.S. startup funding last year went to AI-focused companies like OpenAI and Anthropic. These firms need massive investments but haven’t yet delivered returns for investors, leaving less funding for others. As a result, many non-AI startups are becoming “zombiecorns”—highly valued but struggling to grow or raise more cash. (Read More)

THIS WEEK’S DIAMOND IN THE ROUGH 💎

Did you hear the joke about the large crowd? It’s a riot. 🙃

This week’s diamond in the rough: Riot Platforms (RIOT)

How is Riot using AI? Riot has long been known for Bitcoin mining. It currently owns and operates North America’s largest Bitcoin mining facility (as measured by developed capacity). However, it is now making a strategic pivot toward AI. By leveraging its vast energy capacity and digital infrastructure in Texas, the company is positioning itself to support high-performance AI computing. This includes exploring partnerships to direct up to 600 megawatts of power toward AI data centers, making Riot a potential key player in the infrastructure backbone supporting AI’s rapid growth.

Why is Riot valuable? In Q1 2025, Riot saw a 104% year-over-year revenue increase to $161.4 million but reported a net loss of $296.4 million as it invested heavily in AI and HPC expansion. Despite short-term losses, analysts remain optimistic: the stock has a “Strong Buy” rating and an average price target of $15.91—nearly double its current price of $8.48. With heavy hedge fund interest and significant growth potential in the AI infrastructure space, Riot is betting big on a long-term AI upside.

HOW ARE THE BIG AI PLAYERS DOING?

FRY-NANCIAL TOOL OF THE WEEK 🔧

Can you afford to quit your job or have another kid? AI can tell you. 😳

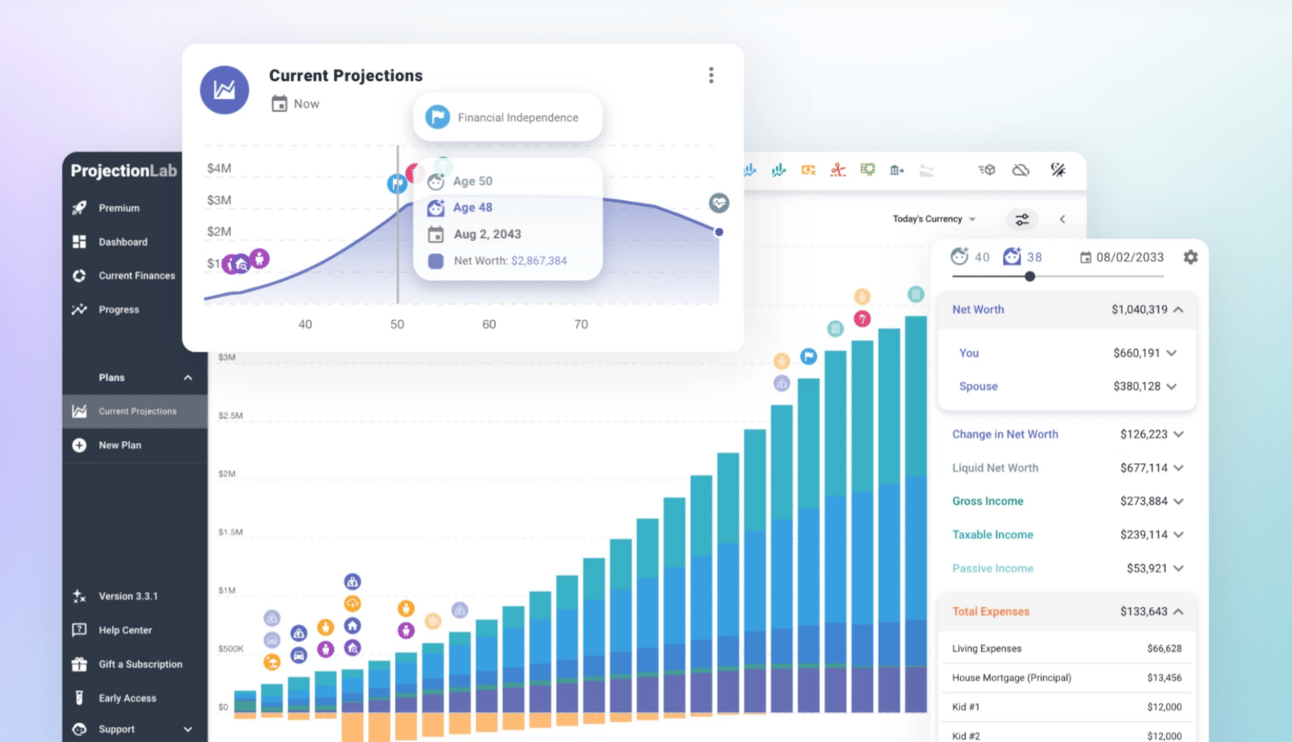

What is the tool? ProjectionLab can help you build a financial plan you will love.

What are the features?

Plan Your Money Over Time: Build custom financial plans to see how your income, spending, savings, and goals play out over the years.

Run "What-If" Scenarios: Test different life paths—like retiring early or changing jobs—to see how they affect your financial future.

See Visual Projections: Get easy-to-read charts showing your cash flow, net worth, and chances of running out of money.

Keep Information Private: You don’t have to connect bank accounts—just enter your numbers manually and keep full control of your data.

FRY-AI FANATIC OF THE WEEK 🍟

Congrats to our subscriber, lbuglisimd! 🎉

lbuglisimd gave us a Fresh and Crispy review and wrote, “It is light and entertaining.”

(Leave a comment for us in any newsletter, and you could be featured next week!)

Turn Anonymous Website Visitors Into Customers With Our AI BDR

Stop letting anonymous site traffic slip away. Our AI BDR Ava identifies individuals on your website without them providing any contact information and autonomously enrolls them into multi-channel sequences.

She operates within the Artisan platform, which consolidates every tool you need for outbound:

300M+ High-Quality B2B Prospects, including E-Commerce and Local Business Leads

Automated Lead Enrichment With 10+ Data Sources

Full Email Deliverability Management

Multi-Channel Outreach Across Email & LinkedIn

Human-Level Personalization

Convert warm leads into your next customers.

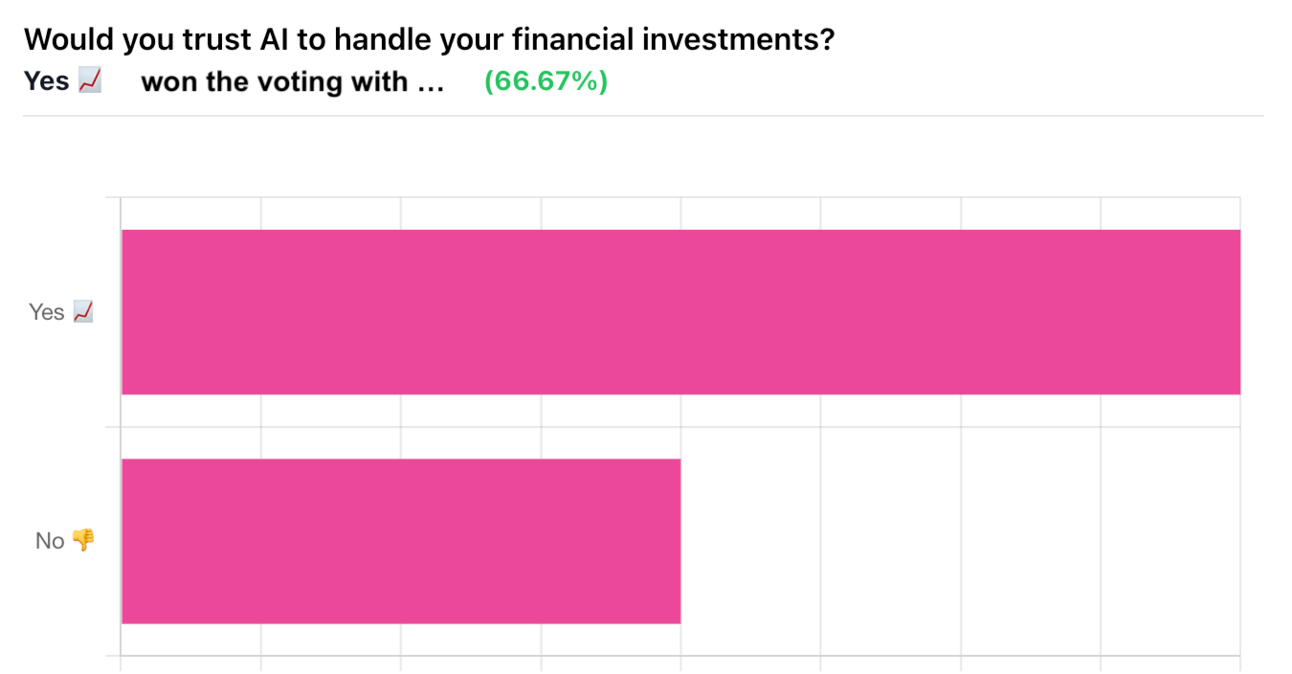

YESTERDAY’S POLL RESULTS 📊

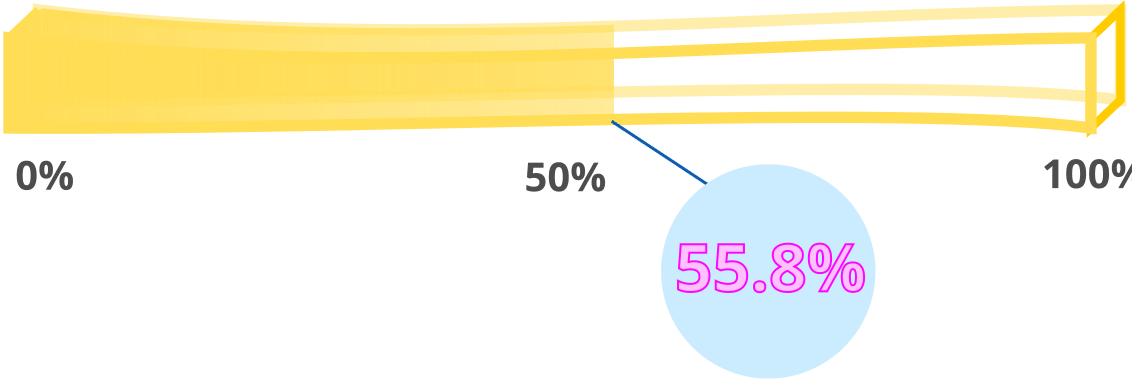

HAS AI REACHED SINGULARITY? CHECK OUT THE FRY METER BELOW:

What do ya think of this latest newsletter?

Your feedback on these daily polls helps us keep the newsletter fresh—so keep it coming!