Our kitchen nearly caught on fire this week with all the FRY-nancial happenings in AI! But we managed to cook them all up for you today. 🔥

*The content provided in this newsletter is for informational purposes only and does not constitute investment advice.*

🤯 MYSTERY AI LINK 🤯

(The mystery link can lead to ANYTHING AI-related: tools, memes, articles, videos, and more…)

Today’s Menu

Appetizer: Salty Stories of the Week 🧂

Entrée: This Week’s Diamond in the Rough 💎

Dessert: FRY-nancial Tool of the Week 🔧

🔨 AI FINANCE TOOLS OF THE DAY

👍 Nexafin: All of your financial accounts in one place. → Check it out

💸 TaxGPT: The tax assistant for professionals and businesses. → Check it out

🤝 Folk: The sales assistant your team never had. → Check it out

SALTY STORIES OF THE WEEK 🧂

Want some seasoning? Here are the saltiest AI stories in FRY-nance from this week:

Tech stocks tumbled in record proportions early this week as investors reacted to the launch of DeepSeek, a low-cost Chinese AI model that outperforms many of the U.S.’s best AI models. Nvidia, a key player in the AI boom, suffered a record $593 billion loss in market value as its stock plummeted 17% on Monday. The selloff spread across global markets, hitting chipmakers, tech firms, and data center companies. Investors fear that DeepSeek’s ability to develop AI using cheaper hardware could disrupt the dominance of U.S. firms like Nvidia, Microsoft, and Google. While some see this as a sign of intensifying competition, uncertainty is driving short-term market volatility. (Read More)

Mark Zuckerberg said that Meta is investing over $60 billion into AI in 2025, spearheaded by a massive AI data center in Louisiana to support the launch of the company’s next-generation AI model, Llama 4. The new data center, located in Richland Parish, Louisiana, will house over 1.3 million GPUs by the year’s end. This project marks a sharp increase in Meta’s spending, surpassing its 2024 capital expenditures of $38-40 billion. (Read More)

Perplexity AI has revised its proposal to merge with TikTok U.S., offering a structure where the U.S. government could own up to 50% of the new company after a future IPO. The plan, which avoids an outright sale, would create a U.S.-based entity called “NewCo,” with ByteDance contributing TikTok U.S. and Perplexity AI joining in exchange for equity. While ByteDance has resisted selling TikTok U.S. outright, Perplexity hopes its merger approach will succeed. (Read More)

THIS WEEK’S DIAMOND IN THE ROUGH 💎

Why can’t computers be in the cold? They get frostbyte. 🥶

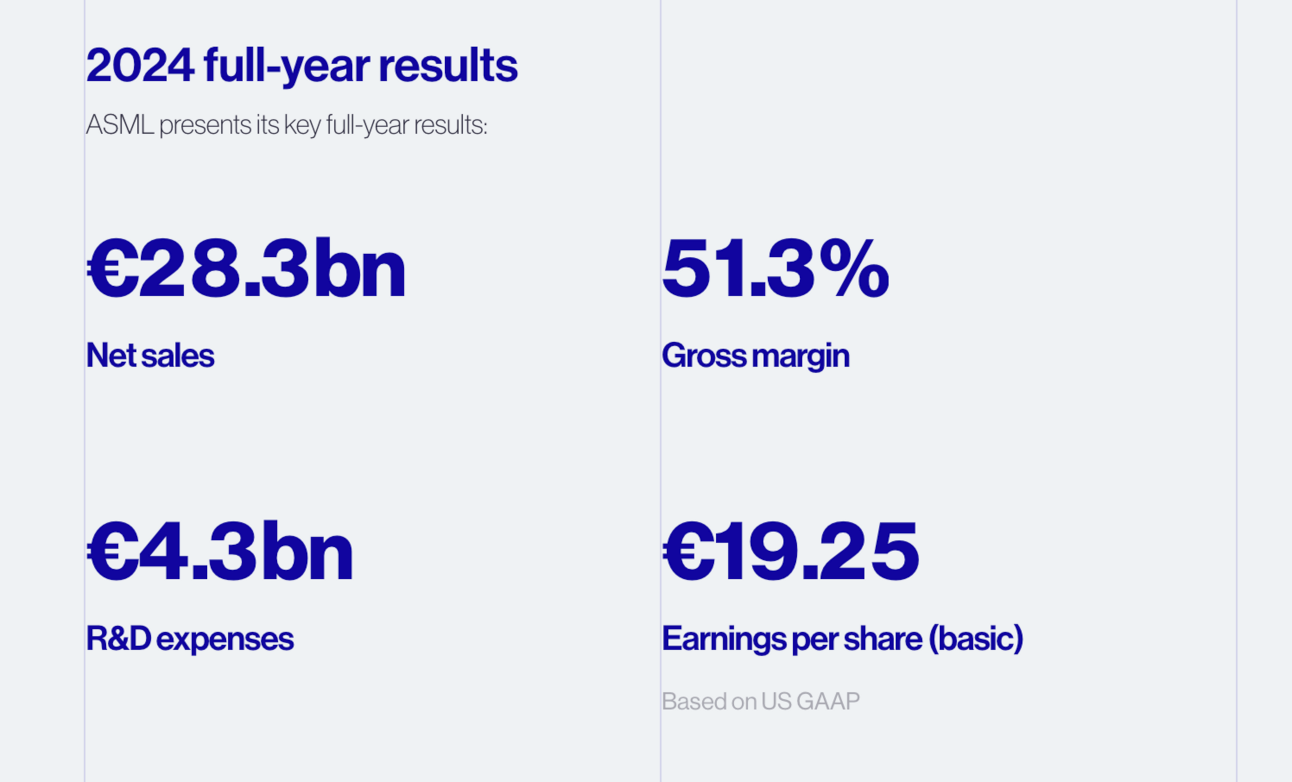

How is ASML using AI? ASML is a Dutch company that produces advanced lithography machines used to manufacture cutting-edge microchips. Its extreme ultraviolet (EUV) technology enables chipmakers like TSMC, Intel, and Samsung to create the most powerful semiconductors in the world, which power AI models and data centers. These chips are essential for AI training and inference, making ASML a key player in the semiconductor supply chain. Without ASML’s precision tools, the rapid advancements in AI, including models like ChatGPT and DeepSeek r1, would not be possible.

Why is ASML valuable? DeepSeek’s recently unveiled r1 model, which claims to outperform existing AI models at a fraction of the cost, initially shook investor confidence in semiconductor companies, causing the industry’s stocks to plunge. Nvidia, for instance, lost nearly $600 billion in market value—the largest single-day drop in U.S. history—before rebounding later in the week. However, ASML CEO Christophe Fouquet remains optimistic about the industry. He noted that tech giants like Microsoft, Meta, and Google continue to invest big money in AI infrastructure, and a lower-cost AI ecosystem could expand adoption for other companies and developers. He stated, “A lower cost of AI could mean more applications. More applications means more demand over time. We see that as an opportunity for more chips demand.”

HOW ARE THE MAGNIFICENT 7 DOING? 📈

Company: | Thursday Closing Price (±% from last week): |

|---|---|

Amazon (AMZN) | $234.64 (-0.3%) |

Apple (AAPL) | $237.59 (+6.2%) |

Alphabet (GOOGL) | $200.87 (+1.5%) |

Meta (META) | $687.00 (+7.9%) |

Microsoft (MSFT) | $414.99 (-7.6%) |

Nvidia (NVDA) | $124.65 (-18.1%) |

Tesla (TSLA) | $400.28 (-3.0%) |

FRY-NANCIAL TOOL OF THE WEEK 🔧

My wallet is like an onion; opening it makes me cry! 🧅

What is the tool? Monarch is a comprehensive personal finance platform that helps users manage budgets, track investments, and plan for financial goals in one place.

What are the features?

Unified Account Tracking: Connect and view all of your bank, credit, and investment accounts in a single dashboard.

Budget Management: Set budgets, categorize expenses, and receive alerts on spending trends.

Goal Setting and Forecasting: Create financial targets and use projections to visualize your progress over time.

Net Worth Monitoring: Track total assets, liabilities, and overall net worth for a complete financial picture.

Collaborative Tools: Invite partners or spouses to share access and collaborate on joint finances.

FRY-AI FANATIC OF THE WEEK 🍟

Congrats to our subscriber, Martha! 🎉

Martha gave us a Sizzling review and wrote, “Thanks for sharing and a couple of laughs to start my day.”

(Leave a comment for us in any newsletter, and you could be featured next week!)

YESTERDAY’S POLL RESULTS 📊

Seeking impartial news? Meet 1440.

Every day, 3.5 million readers turn to 1440 for their factual news. We sift through 100+ sources to bring you a complete summary of politics, global events, business, and culture, all in a brief 5-minute email. Enjoy an impartial news experience.