Good morning, and happy FRY-nancial FRY-day! AI has the financial world in a tizzy, so let’s check it out. 🤪

*Nothing we offer constitutes investment advice. Our aim is to report the latest happenings and teach you how to use the newest AI finance tools.*

🤯 MYSTERY AI LINK 🤯

(The mystery link can lead to ANYTHING AI-related: tools, memes, articles, videos, and more…)

Today’s Menu

Appetizer: Hebbia and Enso lead AI startup surge 🦾

Entrée: This week’s diamond in the rough 💎

Dessert: Manage your investments like a pro 📈

🔨 AI TOOLS OF THE DAY

🤑 Fama One: Let AI invest your money in crypto. → check it out

🧠 Finance Brain: Get instant answers for finance and accounting. → check it out

💳 Borrowly: Have AI answer your credit questions. → check it out

HEBBIA AND ENSO LEAD AI STARTUP SURGE 🦾

Q: Why did the entrepreneur start a bakery?

A: He wanted to make some dough. 🍩

What’s going on? This week marked a surge for AI startups, led by Hebbia and Enso, which underscores hope for small AI companies amidst an industry boom largely driven by large powerhouses.

What’s up with Hebbia? Hebbia, an AI startup focusing on document analysis, has secured $130 million in a Series B funding round, elevating its valuation to approximately $700 million. The startup’s core product, Matrix, can process extensive documents and provide detailed, tabular responses to complex inquiries, making it invaluable for companies across a variety of industries. It currently sells its software primarily to asset managers, investment banks, and other financial institutions. Due to high demand, Hebbia’s profits have increased 15x over the last 18 months. The company is planning to use this new funding to expand its offerings to other areas, including law firms and pharmaceutical companies.

What about Enso? Enso focuses on giving small and medium-sized businesses (SMBs) access to a wide range of pre-programmed AI agents that can handle repetitive tasks. These industry-specific agents promise to help customers do anything from managing their search engine optimization efforts to engaging with their Instagram followers, tracking competitors, writing newsletters, managing invoices, and optimizing their Amazon stores. These agents can help SMBs efficiently manage tasks and reduce costs. Enso pre-trains and customizes these agents for about 70 different industries, offering more than 1,000 bots in total. This week, AI startup Enso announced a $6 million seed funding round, which will help them expand their arsenal even further.

THIS WEEK’S DIAMOND IN THE ROUGH 💎

The AI boom is being driven by more than just the tech giants. 🤖

How is AI helping Corning? Corning is a technology company that manufactures components for consumer electronics, medical equipment, data centers, and more. Its main contribution is fiberoptic cables, enabling long-distance light transmission with minimal signal loss. These cables are essential for high-speed data transfer, which is integral to the functioning of data centers. Corning’s RocketRibbon cable is its bread and butter, with a 60% smaller diameter than those of the big tech players. This offers high fiber density, saving valuable space in data centers that use miles of cabling.

Want some numbers? Corning generated $1.67 in earnings per share over the last four quarters. In Q1 2024, despite a 17% decline in its optical communications revenue, Corning reported promising customer acquisitions for new data center builds, currently one of the biggest pushes in the AI industry. This momentum, driven by demand for AI power, led Corning to revise its Q2 revenue forecast from $3.4 billion to $3.6 billion. Not to mention, the company just declared a second-quarter dividend of $0.28 per share, which represents an annualized yield of 2.6%.

HOW ARE THE MAGNIFICENT 7 DOING? 📈

Company: | Thursday Closing Price (±% from last week): |

|---|---|

Amazon (AMZN) | $195.05 (-1.3%) |

Apple (AAPL) | $227.57 (+2.7%) |

Alphabet (GOOGL) | $185.57 (-0.1%) |

Meta (META) | $512.70 (+0.5%) |

Microsoft (MSFT) | $454.70 (-1.3%) |

Nvidia (NVDA) | $127.40 (-0.7%) |

Tesla (TSLA) | $241.03 (-2.2%) |

MANAGE YOUR INVESTMENTS LIKE A PRO 📈

My knife stock is up sharply, but my soda stock has fizzled. 😆

What’s the tool? Basil is an AI-powered app that serves as the ultimate solution for tracking and managing your investments.

How does it work? Effortlessly connect your various financial accounts—from banks and stock brokerages to retirement plans and crypto exchanges—to experience the following features:

Unified Portfolio Dashboard: Get a comprehensive view of your entire financial world in a user-friendly interface.

Portfolio Insights: Receive detailed, real-time analyses of your investment portfolio.

Investment Performance Tracking: Monitor your portfolio’s growth and benchmark against key financial indicators and personalized goals.

Portfolio Notifications: Build custom watchlists and get timely updates on your assets’ performance.

Personal AI Assistant: Chat about your money with a personalized AI bot.

Financial Summaries: Enjoy automated, easy-to-understand summaries of complex financial data.

FRY-AI FANATIC OF THE WEEK 🍟

Congrats to our subscriber, birdie! 🎉

Birdie gave us a Sizzlin’ review on Sunday’s Deep-fried Dive with Fry Guy and wrote, “Definitely Sizzlin’! This is what’s on everyone’s mind.”

(Leave a comment for us in any newsletter, and you could be featured next week!)

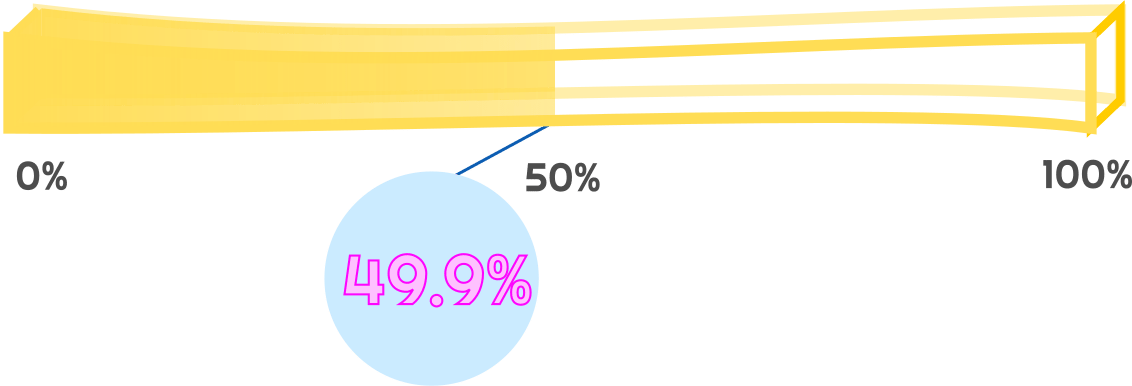

YESTERDAY’S POLL RESULTS 📊

Featured comments:

“I haven’t had a need to venture outside ChatGPT yet. The responses have been dead-on.” (ChatGPT 🦾)

“Perplexity is my favorite.” (Other 👀)