Hello, and happy FRY-nancial FRY-day! Let’s make your finances sizzle with AI insights that are hotter than a fresh batch of fries. 🍟

*Nothing we offer constitutes investment advice. Our aim is to report on the latest happenings and teach you how to use the newest AI finance tools.*

🤯 MYSTERY AI LINK 🤯

(The mystery link can lead to ANYTHING AI-related: tools, memes, articles, videos, and more…)

Today’s Menu

Appetizer: Salty Stories of the Week 🧂

Entrée: This Week’s Diamond in the Rough 💎

Dessert: FRY-nancial Tool of the Week 🔧

🔨 AI FINANCE TOOLS OF THE DAY

🤖 Lynq: Automate financial tasks, generate insights, and streamline reporting effortlessly. → Check it out

📈 Alphastream: Transform capital markets with AI-driven, real-time data extraction. → Check it out

🥷 Transparently AI: Use AI to detect accounting manipulation and fraud → Check it out

SALTY STORIES OF THE WEEK 🧂

Want some seasoning? Here are the saltiest AI stories in FRY-nance from this week:

Google has rehired Noam Shazeer after he left the company in 2021 to form his own AI project, Character.ai, a chatbot service that allows users to have conversations with AI characters that can generate human-like text responses. Google paid $2.7 billion to license Character AI’s technology as part of the deal. (Read More)

BlackRock, Microsoft, and Abu Dhabi-backed investment company MGX have announced a collaboration to launch a fund exceeding $30 billion, targeting investments in AI infrastructure. This initiative, named the Global AI Infrastructure Investment Partnership, will support the development of AI supply chains and energy solutions. (Read More)

The Federal Trade Commission (FTC) is taking legal action against five companies accused of using AI in deceptive and unfair ways. According to the FTC, these companies employed AI tools to mislead, trick, or defraud consumers, violating established consumer protection laws. (Read More)

THIS WEEK’S DIAMOND IN THE ROUGH 💎

A sweater I bought was picking up static electricity. So, I returned it to the store and they gave me another one free of charge. 🔌

This week’s diamond in the rough: Modine Manufacturing Co. (MOD).

How is AI helping Modine? Modine Manufacturing is a Wisconsin-based leader in thermal management solutions and finds AI applications in data centers. Its Airedale system, in particular, has an “unrivaled pedigree” in providing flexible, high efficiency data center cooling solutions. As a result, the company has seen significant growth with a market capitalization of $6.8 billion. During its Investor Day on September 11, the company outlined a multi-year growth strategy, with particular focus on expanding its presence in the data center market. As more tech companies invest in data center infrastructure, Modine expects data center revenue to account for 30% of its total revenue by fiscal year 2027, up from just 12% in FY 2024.

Want some numbers? Modine’s growth potential is reflected in the company’s stock performance, with shares soaring around 165% over the past year. Despite this surge, Modine's price-to-earnings-to-growth (PEG) ratio remains a compelling 0.9. A PEG ratio under 1.0 typically suggests that a stock is undervalued relative to its growth prospects, indicating it offers both value and strong growth potential.

HOW ARE THE MAGNIFICENT 7 DOING? 📈

Company: | Thursday Closing Price (±% from last week): |

|---|---|

Amazon (AMZN) | $191.16 (+0.7%) |

Apple (AAPL) | $227.52 (-0.6%) |

Alphabet (GOOGL) | $162.73 (+0.1%) |

Meta (META) | $567.84 (+1.6%) |

Microsoft (MSFT) | $431.31 (-1.7%) |

Nvidia (NVDA) | $124.04 (+5.2%) |

Tesla (TSLA) | $254.22 (+4.2%) |

FRY-NANCIAL TOOL OF THE WEEK 🔧

We don’t get any perks for sharing this tool—we just want you to show you how cool AI tools like this can be used to enhance personal finance. 😁

What’s the tool? Pluto is an AI-powered financial assistant that helps users manage their investments by providing real-time data analysis and multimodal insights.

How to use the tool:

Safely sync your financial portfolio accounts with Pluto.

Use GPT-4-powered AI to ask personalized investment questions.

Receive instant summaries, market data, and charts based on over 40 data sources.

Get customized prompts and scheduled updates to track your goals and stay informed about your investments.

Access features like portfolio optimization, net-worth tracking, and dynamic cash flow monitoring to enhance financial planning.

FRY-AI FANATIC OF THE WEEK 🍟

Congrats to our subscriber, AJ! 🎉

AJ gave us a Fresh and Crispy review and wrote, “I can not imagine living life without these daily doses of AI crispy informative bits.”

(Leave a comment for us in any newsletter, and you could be featured next week!)

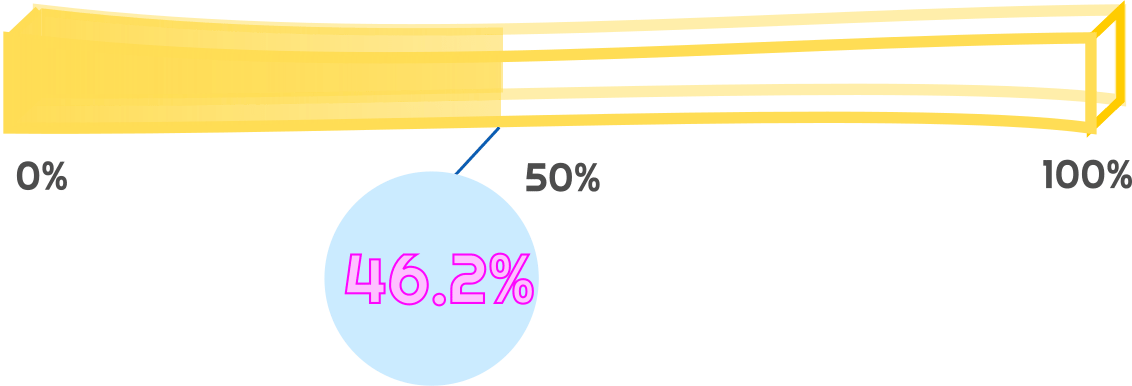

YESTERDAY’S POLL RESULTS 📊

Featured comments:

“[AI] expanded my thought processes and ideas for improved applications.” (Yes 🤖)

“I’m just out of the loop …being retired.” (No 🤷♀️)

“As a software developer … Mostly I’m reviewing AI code now.” (Yes 🤖)