Happy FRY-nancial FRY-day! On FRY-days, we cook up all things AI and FRY-nance—let’s get to it! 🤑

*The content provided in this newsletter is for informational purposes only and does not constitute investment advice.*

🤯 MYSTERY AI LINK 🤯

(The mystery link can lead to ANYTHING AI-related: tools, memes, articles, videos, and more…)

The AI Insights Every Decision Maker Needs

You control budgets, manage pipelines, and make decisions, but you still have trouble keeping up with everything going on in AI. If that sounds like you, don’t worry, you’re not alone – and The Deep View is here to help.

This free, 5-minute-long daily newsletter covers everything you need to know about AI. The biggest developments, the most pressing issues, and how companies from Google and Meta to the hottest startups are using it to reshape their businesses… it’s all broken down for you each and every morning into easy-to-digest snippets.

If you want to up your AI knowledge and stay on the forefront of the industry, you can subscribe to The Deep View right here (it’s free!).

SALTY STORIES OF THE WEEK 🧂

Walmart CEO Doug McMillon says AI will “change literally every job,” emphasizing that no role is likely to remain untouched. He expects the shift to be gradual, with some areas like call centers automating faster than others. Rather than mass layoffs, however, Walmart plans to keep its workforce size steady over the next three years by adjusting the mix of roles and adding new positions like AI tool developers while phasing out others. The company is still assessing exactly how job composition will change. (Read More)

Lufthansa, a major airline based in Germany, announced it will cut 4,000 jobs by 2030 as part of a major restructuring plan aimed at boosting profits and embracing AI-driven efficiency. Lufthansa is leaning on AI to streamline operations and reduce the need for certain roles. (Read More)

Meta is looking to boost its AI infrastructure to meet surging demand, first striking a $14.2 billion deal with CoreWeave to rent access to powerful Nvidia-backed server racks, then acquiring chip startup Rivos to accelerate its in-house chip development. The CoreWeave deal gives Meta immediate access to cutting-edge AI compute power as it builds out massive data centers, while the Rivos acquisition signals a long-term strategy to reduce dependence on external chip suppliers like Nvidia. (Read More)

THIS WEEK’S DIAMOND IN THE ROUGH 💎

This week’s diamond in the rough: Lemonade

How is Lemonade using AI? Lemonade is transforming the insurance industry with an AI-first approach that automates everything from customer onboarding to claims processing. Its chatbot handles most customer interactions, while machine learning models assess risk, detect fraud, and make underwriting decisions in real time. This tech-driven model allows Lemonade to reduce costs, improve efficiency, and offer a more transparent and user-friendly experience. The company also has a unique Giveback program, where leftover premiums are donated to charities chosen by customers. This reinforces trust and loyalty, all while operating as a Public Benefit Corporation.

Why is Lemonade valuable? As of Q2 2025, Lemonade has surpassed $1.07 billion in in-force premiums and serves 2.6 million active users across the U.S. and Europe. Its gross loss ratio improved significantly from 79% to 67% year-over-year, signaling better underwriting and risk management. Pet insurance, a major growth area, reached $350 million in premiums with low market penetration in the U.S., while European premiums grew 200% to $43 million. With a market cap of $3.8 billion and trading well below historical valuation levels, Lemonade’s strong growth in premium volume, product expansion, and improving unit economics position it for success in the long-term.

HOW ARE THE BIG AI PLAYERS DOING?

Founders need better information

Get a single daily brief that filters the noise and delivers the signals founders actually use.

All the best stories — curated by a founder who reads everything so you don't have to.

FRY-NANCIAL TOOL OF THE WEEK 🔧

What is the tool? AlphaAI Capital helps users get AI-driven insights to optimize their portfolio.

How can you get started?

Define your investor profile: Answer a few simple questions about how you like to invest.

Customize your investment strategy: AlphaAI Capital will recommend the best strategy for you based on your tolerance for risk, volatility, and drawdowns.

Sit back and relax: As the market ebbs and flows, AlphaAI Capital will dynamically adjust your portfolio, ensuring optimal performance.

FRY-AI FANATICS OF THE WEEK 🍟

Some of our best Fresh and Crispy reviews of the week:

“I’m new to AI and incorporating it into my life. Everything I read is new and different and exciting. It’s overwhelming, so everything on your newsletter is a breath of fresh air and a moment to be less overwhelmed by all this new information.”

“Fresh and to the point.”

“FRY-days, because when you’re deep in AI financial coverage, everything should come with extra grease and sizzle.🧂 Thanks so much!”

“Very informative. Short and to the point.”

“Appeals to my ‘tastes.’”

(Leave a comment for us in any newsletter, and you could be featured next week!)

YESTERDAY’S POLL RESULTS 📊

Featured comments:

“Play around with making videos all the time.” (Yes 🦾)

“Yes, I have tried several AI video generation platforms with mixed results. I find it is not as easy as they lead you to believe and if you want to produce quality videos expect to do some editing and to have a learning curve. Also be aware of credit consumption and anticipate being bumped to upgrade or buy more credits.” (Yes 🦾)

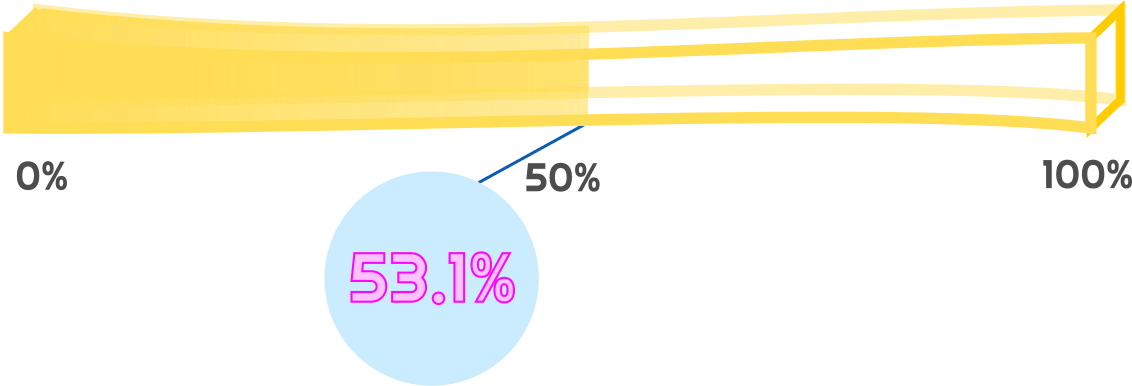

HAS AI REACHED SINGULARITY? CHECK OUT THE FRY METER BELOW:

What do ya think of this latest newsletter?

Your feedback on these daily polls helps us keep the newsletter fresh—so keep it coming!