It’s tater tot Tuesday, so grab your favorite dipping sauce and let’s chow down on the freshest and crispiest AI news around! 🍟

Today’s Menu

Appetizer: Dungeons & Dragons says “no” to AI 🐲

Entrée: Alibaba wants in on AI 🦾

Dessert: 47% of Warren Buffett’s portfolio is in AI 💰

🔨 AI TOOLS OF THE DAY

🤬 Venty.chat: An AI tool providing a safe space for users to express thoughts and rants, offering active listening, empathy, and thoughtful replies without judgment. → check it out

📑 SpinDoc: Chat with complex technical documents and get the answers you need. → check it out

🧠 MyndMap: Software designed to streamline productivity and support individuals with ADHD. → check it out

DUNGEONS & DRAGONS SAYS “NO” TO AI 🐲

Nerds beware … Dungeons and Dragons has made headlines! 🤓

What’s up? The iconic Dungeons & Dragons (D&D) franchise has taken a firm stance against the use of AI technology in the creation of its enchanting artwork, including its cast of wizards, druids, and other captivating figures.

Why? D&D Beyond, an online platform providing companion content for the franchise, discovered that an artist they had collaborated with for nearly a decade had employed AI to craft artwork for an upcoming book. The franchise, overseen by Hasbro subsidiary Wizards of the Coast, swiftly issued a statement outlining that AI-generated art would not be accepted in the creative process for D&D.

What are the implications? AI's presence in creative domains has raised concerns about copyright, labor practices, and artistic integrity. The case of D&D underscores the delicate balance between technological innovation and preserving the unique, human touch that defines genuine creativity. As the art world navigates the intersection of AI and human creativity, the decision taken by the D&D franchise serves as a significant marker of where the boundaries are drawn in this evolving landscape.

ALIBABA WANTS IN ON AI 🦾

There is a giant AI party going on, and one of the world’s largest companies is joining in! 🥳

What’s up? Alibaba, the world’s largest e-commerce company, announced the open-sourcing of their seven-billion-parameter model named Qwen-7B, along with another version specifically tailored for conversational apps, called Qwen-7B-Chat.

Why? By open-sourcing its technology, Alibaba won't earn licensing fees, but it aims to attract more users for its AI model. This move aligns with the company's focus on bolstering its cloud computing division by investing in AI, recognizing cloud computing as a vital area for future growth and profitability.

What does this mean? This move puts Alibaba in potential competition with U.S. tech giant Meta, which has also taken a similar step. This move by a giant company like Alibaba could also present a challenge to OpenAI, the company behind the popular AI chatbot, ChatGPT.

47% OF WARREN BUFFETT’S PORTFOLIO IS IN AI 💰

Since assuming leadership of Berkshire Hathaway in 1965, Warren Buffett has managed to achieve a cumulative increase of 4,362,780% in the value of Berkshire's Class A shares (BRK.A). 😳

What’s up? $177 billion (47.3%) of the $375 billion investment portfolio under Warren Buffett's supervision at Berkshire Hathaway is allocated to only three AI stocks.

Where is Buffett investing this money?

Apple: $175 billion

Apple is Apple. What more can be said? They have continually looked for ways to implement AI technology into their physical products as well as hundreds of applications.

Amazon: $1.3 billion

Amazon has showcased substantial integration of AI across various aspects of its operations, notably leveraging AI-driven recommendations for enhancing user experiences in its online marketplace, as well as recently capitalizing on the success of AI-assistant Alexa to secure a significant share in the global smart-speaker market.

Snowflake: $987 million

Snowflake has had a strategic focus on cloud infrastructure, seamless data-sharing solutions, and recent integration of generative AI capabilities, although its stock valuation and recent fluctuations in sales growth warrant cautious consideration.

🚨 This is NOT to be taken as investment advice from the Fry Guy. Rather, it is meant to display a recent revealing of Warren Buffett’s portfolio, which is heavily invested in AI-driven companies.

TWITTER TUESDAY 🐦

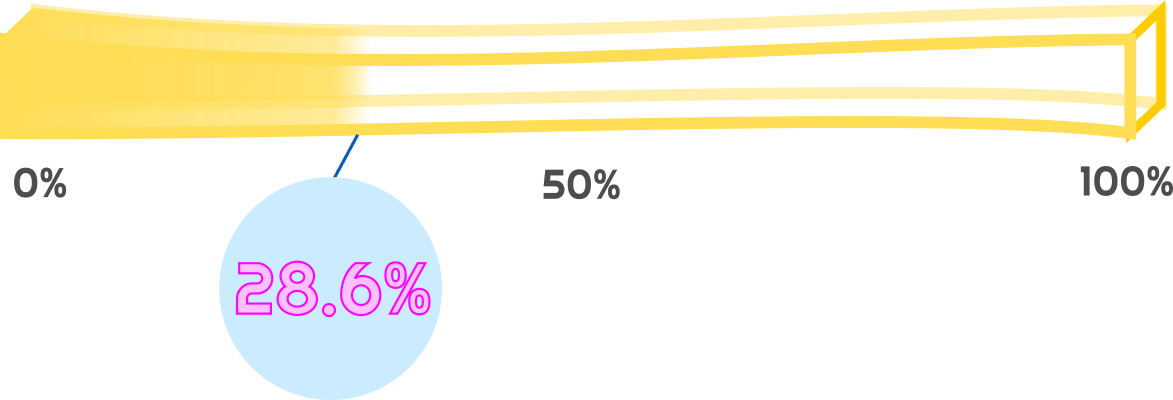

HAS AI REACHED SINGULARITY? CHECK OUT THE FRY METER BELOW

U.S lawmakers, in what seems like a scene from “Groundhog Day”, continue to warn that, “They’re going to get tough on AI”, yet no regulation laws are implemented. Sadly, China is the only country taking A.I. regulation seriously.